This article is about

how much VAT refund you can get in Europe.Europe is an amazing place to shop for designer bags. Think about it; Italy is famous for their impeccable leather craftsmanship and give rise to world-class brands like Prada, Tods, Dolce

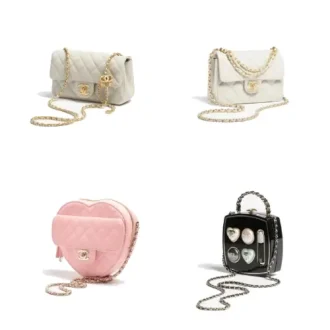

Gabbana, Valentino and Marni. Paris is known for romance, but also for high fashion. Did you know that the term Haute Couture (which translates to High Fashion in English) is protected by French law and is verified by the Chambre de Commerce et d’industrie? There are actually regulations that define which fashion houses are true Haute Couture. Chanel, Yves Saint Laurent and Christian Dior are all founded in France.[lwptoc]There is another reason why Europe is an amazing destination to buy designer bags. In general, the prices are much lower than other parts of the world. In the top of that, tourist gets VAT back, which can be up to 10% of the purchase price, depending on the country you’re going to visit. Let’s see the rate of tax-refund per country in Europe.

VAT refund overview per EU country

Note: the minimum value is 175 euro to be eligible for tax-refund, the VAT-free goods need to leave EU by the end of the third month.VAT refund in France

| Value | VAT Refund in € | VAT Refund in % |

| €500 | €60 | 12,00% |

| €1000 | €120 | 12,00% |

| €2000 | €240 | 12,00% |

| €3000 | €360 | 12,00% |

| €4000 | €480 | 12,00% |

| €5000 | €600 | 12,00% |

| €6000 | €720 | 12,00% |

| €7000 | €840 | 12,00% |

| €8000 | €960 | 12,00% |

| €9000 | €1080 | 12,00% |

| €10000 | €1200 | 12,00% |

VAT refund in Spain

| Value | VAT Refund in € | VAT Refund in % |

| €500 | €60 | 12,00% |

| €1000 | €128,50 | 12,85% |

| €2000 | €281 | 14,05% |

| €3000 | €435 | 14,50% |

| €4000 | €596 | 14,90% |

| €5000 | €765 | 15,30% |

| €6000 | €942 | 15,70% |

| €7000 | €1099 | 15,70% |

| €8000 | €1256 | 15,70% |

| €9000 | €1413 | 15,70% |

| €10000 | €1570 | 15,70% |

VAT refund in Netherlands

| Value | VAT Refund in € | VAT Refund in % |

| €500 | €52 | 10,40% |

| €1000 | €112 | 11,20% |

| €2000 | €251 | 12,55% |

| €3000 | €392 | 13,07% |

| €4000 | €556 | 13,90% |

| €5000 | €750 | 15,00% |

| €6000 | €900 | 15,00% |

| €7000 | €1050 | 15,00% |

| €8000 | €1200 | 15,00% |

| €9000 | €1350 | 15,00% |

| €10000 | €1500 | 15,00% |

VAT refund in Germany

| Value | VAT Refund in € | VAT Refund in % |

| €500 | €57 | 11,40% |

| €1000 | €114 | 11,40% |

| €2000 | €242 | 12,10% |

| €3000 | €390 | 13,00% |

| €4000 | €530 | 13,25% |

| €5000 | €680 | 13,60% |

| €6000 | €830 | 13,83% |

| €7000 | €1015 | 14,50% |

| €8000 | €1160 | 14,50% |

| €9000 | €1305 | 14,50% |

| €10000 | €1450 | 14,50% |

VAT Refund in Belgium

| Value | VAT Refund in € | VAT Refund in % |

| €500 | €56 | 11,20% |

| €1000 | €118 | 11,80% |

| €2000 | €247 | 12,35% |

| €3000 | €396 | 13,20% |

| €4000 | €536 | 13,40% |

| €5000 | €700 | 14,00% |

| €6000 | €840 | 14,00% |

| €7000 | €1015 | 14,50% |

| €8000 | €1160 | 14,50% |

| €9000 | €1305 | 14,50% |

| €10000 | €1500 | 15,00% |

VAT Refund in Greece

| Value | VAT Refund in € | VAT Refund in % |

| €500 | €59 | 11,80% |

| €1000 | €124 | 12,40% |

| €2000 | €264 | 13,20% |

| €3000 | €417 | 13,90% |

| €4000 | €573 | 14,33% |

| €5000 | €738 | 14,76% |

| €6000 | €942 | 15,70% |

| €7000 | €1099 | 15,70% |

| €8000 | €1256 | 15,70% |

| €9000 | €1413 | 15,70% |

| €10000 | €1600 | 16,00% |

VAT Refund in Italy

| Value | VAT Refund in € | VAT Refund in % |

| €500 | €65 | 13,00% |

| €1000 | €129 | 12,90% |

| €2000 | €270 | 13,50% |

| €3000 | €420 | 14,00% |

| €4000 | €560 | 14,00% |

| €5000 | €750 | 15,00% |

| €6000 | €900 | 15,00% |

| €7000 | €1050 | 15,00% |

| €8000 | €1240 | 15,50% |

| €9000 | €1395 | 15,50% |

| €10000 | €1550 | 15,50% |

VAT Refund in Austria

| Value | VAT Refund in € | VAT Refund in % |

| €500 | €59 | 11,80% |

| €1000 | €125 | 12,50% |

| €2000 | €260 | 13,00% |

| €3000 | €390 | 13,00% |

| €4000 | €520 | 13,00% |

| €5000 | €700 | 14,00% |

| €6000 | €840 | 14,00% |

| €7000 | €980 | 14,00% |

| €8000 | €1160 | 14,50% |

| €9000 | €1305 | 14,50% |

| €10000 | €1500 | 15,00% |

VAT Refund in Denmark

| Value | VAT Refund in kr | VAT Refund in % |

| kr5000 | kr678 | 13,56% |

| kr10000 | kr1359 | 13,59% |

| kr20000 | kr3200 | 16,00% |

| kr30000 | kr5250 | 17,50% |

| kr40000 | kr7000 | 17,50% |

| kr50000 | kr8750 | 17,50% |

| kr60000 | kr11400 | 19,00% |

| kr70000 | kr13300 | 19,00% |

| kr80000 | kr15200 | 19,00% |

| kr90000 | kr17100 | 19,00% |

| kr100000 | kr19000 | 19,00% |

Need-to-knows- Denmark has a very high VAT rate of 25%

- There is also a minimum purchase value of total kr300 before you are elible to apply for tax-refund.

VAT Refund in Hungary

| Value | VAT Refund in Ft | VAT Refund in % |

| Ft150000 | Ft21100 | 14,07% |

| Ft300000 | Ft42700 | 14,23% |

| Ft600000 | Ft89900 | 14,98% |

| Ft900000 | Ft149400 | 16,60% |

| Ft1200000 | Ft199200 | 16,60% |

| Ft1500000 | Ft267000 | 17,80% |

| Ft1800000 | Ft320400 | 17,80% |

| Ft2100000 | Ft399000 | 19,00% |

| Ft2400000 | Ft456000 | 19,00% |

| Ft2700000 | Ft513000 | 19,00% |

| Ft3000000 | Ft570000 | 19,00% |

Need-to-knows- Hungary a VAT rate of 27%

- The minimum purchase amount is Ft54001

VAT Refund in Ireland

| Value | VAT Refund in € | VAT Refund in % |

| €500 | €68 | 13,60% |

| €1000 | €139 | 13,90% |

| €2000 | €300 | 15,00% |

| €3000 | €450 | 15,00% |

| €4000 | €600 | 15,00% |

| €5000 | €775 | 15,50% |

| €6000 | €930 | 15,50% |

| €7000 | €1085 | 15,50% |

| €8000 | €1240 | 15,50% |

| €9000 | €1395 | 15,50% |

| €10000 | €1600 | 16,00% |

VAT Refund in Luxembourg

| Value | VAT Refund in € | VAT Refund in % |

| €500 | €48 | 9,60% |

| €1000 | €98 | 9,80% |

| €2000 | €201 | 10,05% |

| €3000 | €318 | 10,60% |

| €4000 | €460 | 11,50% |

| €5000 | €575 | 11,50% |

| €6000 | €690 | 11,50% |

| €7000 | €805 | 11,50% |

| €8000 | €960 | 12,00% |

| €9000 | €1080 | 12,00% |

| €10000 | €1200 | 12,00% |

VAT Refund in Portugal

| Value | VAT Refund in € | VAT Refund in % |

| €500 | €68 | 13,60% |

| €1000 | €139 | 13,90% |

| €2000 | €280 | 14,00% |

| €3000 | €420 | 14,00% |

| €4000 | €560 | 14,00% |

| €5000 | €725 | 14,50% |

| €6000 | €870 | 14,50% |

| €7000 | €1015 | 14,50% |

| €8000 | €1160 | 14,50% |

| €9000 | €1305 | 14,50% |

| €10000 | €1500 | 15,00% |

VAT Refund in Sweden

| Value | VAT Refund in € | VAT Refund in % |

| kr5000 | kr673 | 13,46% |

| kr10000 | kr1383 | 13,83% |

| kr20000 | kr2950 | 14,75% |

| kr30000 | kr4800 | 16,00% |

| kr40000 | kr6400 | 16,00% |

| kr50000 | kr8000 | 16,00% |

| kr60000 | kr10200 | 17,00% |

| kr70000 | kr11900 | 17,00% |

| kr80000 | kr14400 | 18,00% |

| kr90000 | kr16200 | 18,00% |

| kr100000 | kr18000 | 18,00% |

Need-to-knows- Sweden has a VAT rate of 25%

- The minimum purchase amount in Sweden is kr200

VAT Refund in United Kingdom

| Value | VAT Refund in £ | VAT Refund in % |

| £500 | £59,5 | 11,90% |

| £1000 | £122 | 12,20% |

| £2000 | £260 | 13,00% |

| £3000 | £405 | 13,50% |

| £4000 | £560 | 14,00% |

| £5000 | £700 | 14,00% |

| £6000 | £850 | 14,17% |

| £7000 | £1016,6 | 14,52% |

| £8000 | £1183,3 | 14,79% |

| £9000 | £1350 | 15,00% |

| £10000 | £1516,6 | 15,17% |

Need-to-knows- UK has a VAT rate of 20%

- The minimum purchase amount is £30 GBP

| Tax refund guide per country |

|

Hi! I am arriving to Amsterdam, then going to Brussels, Vienna, Prague and back to Amsterdam where I am flYing back home. I want to buy a Chanel/Dior bag.

Where should I do my tax return? If I buy it in Brussels, Vienna or Prague…

Will they return the tax when I am leaving the EU from Amsterdam?

Hi, are the Chanel prices on their Euro site already tax included?

Yes, all the prices in Europe are tax included.

Hello,

Any tips on trying to get a mini coco handle bag while I’m in Barcelona? Can I call in advance to reserve?

Also when I go back to the US, does the person who paid for the bag have to be the one to declare with customs?

Thanks 🙂

You can call Chanel customer service in Europe and ask them where this bag is available, they can help. For the 2nd question, as far as I can remember, anyone can claim it.

Hi I want to purchase a bag from Greece price at 3150 in total so what would the tax refund I will received after the minus the admin fee?

Hi Cindy, the total tax-refund will be 431 usd (including admin fee and commission). This is what you will receive.

I just came back from Paris and managed to score a classic medium carviar in medium. There’s no stocks in Amsterdam, Brussels, Milan nor Rome.

Was it hard to find this bag? Thanks for sharing!

Hello, I’m planning to fly to Iceland then london then amsterdam then back to iceland before heading back to the states. If I were to buy a bag either in london or amsterdam, which country would be my last port for VAT refund processing? I really hope it’s not iceland 🙁

Not iceland as they use a different currency. Your last stop to apply for tax-refund will be in Amsterdam.